Eric C. Boughman

Eric leads the firm's healthcare and technology practices. He is a frequent writer and presenter on issues involving health law, privacy, technology, and asset protection. His writings have appeared in multiple American Bar Association publications, The Florida Bar Journal, Forbes, Daily Business Review, Accounting Today, Financial Advisor Magazine, Law360, and CEO World, among others. Eric is rated AV–Preeminent by Martindale-Hubbell. He has been admitted to practice law in Florida and Nevada, as well as in the U.S. Tax Court, and in several other courts, nationwide, pro hac vice. He is a member of the ABA’s Healthcare Law Section, Business Law Section, and Cyberspace Law Committee, the American Healthcare Lawyers Association, and American College of Healthcare Executives. He graduated, magna cum laude, from the University of Minnesota Law School. He also holds a Health Law Certificate from the University of Louisville, Brandeis School of Law. Eric earned his undergraduate degree from the University of Maryland while he was serving in the U.S. Air Force, during which time his duty included tours in Saudi Arabia and Turkey in support of operations Desert Storm and Provide Comfort.

Tuesday, 18 June 2019 20:00

Eric presents his seminar on "Privacy in Healthcare: Artificial Intelligence and the Potential Perils of Connected Medical Devices" via Live National Webinar

Privacy in Healthcare: Artificial Intelligence and the Potential Perils of Connected Medical Devices

Recorded: June 19, 2019

Eric continues our Privacy in Healthcare series as he presents his seminar on Artificial Intelligence and the Potential Perils of Connected Medical Devices via Live National Webinar.

Learn about the potential perils created by artificial intelligence and big data with a particular focus on the areas not covered by HIPAA privacy and security rules.

Click here for replay.

Recorded: June 19, 2019

Eric continues our Privacy in Healthcare series as he presents his seminar on Artificial Intelligence and the Potential Perils of Connected Medical Devices via Live National Webinar.

Learn about the potential perils created by artificial intelligence and big data with a particular focus on the areas not covered by HIPAA privacy and security rules.

Click here for replay.

Published in

Press Releases

Monday, 12 November 2018 19:00

Eric presents on "Establishing a Business in the U.S." to foreign business owners, professionals, and investors at the Volusia County Business Incubator's Establish Your Business in the U.S. as a Platform for Global Reach Conference in Daytona Beach

Published in

Press Releases

Tagged under

Monday, 02 July 2018 20:00

How Does the GDPR Affect My U.S.-Based Medical Practice?

Published in

Publications

Tagged under

Tuesday, 29 May 2018 04:29

Hold On – Does Everyone Need to Comply with the GDPR?

Published in

Publications

Tagged under

Thursday, 03 May 2018 04:00

Eric presents with Matt Rose on Cyber Risk Management and Insurance at the UCF Business Incubator

Click here for more information.

Published in

Press Releases

Tagged under

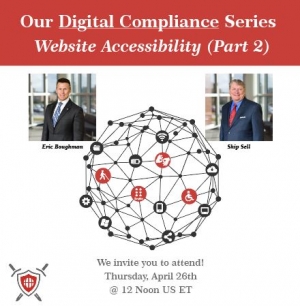

Thursday, 26 April 2018 08:00

Our April webinar from the Digital Compliance series: Website Accessibility (part 2)

Click here to register!

Published in

Press Releases

Tagged under

Wednesday, 21 March 2018 21:48

Our March webinar from the Digital Compliance series: Website Accessibility (part 1)

Click here to register!

Published in

Press Releases

Tagged under

Wednesday, 14 March 2018 18:23

How to Address Website Accessibility Issues Now

Published in

Publications

Tagged under

Thursday, 01 March 2018 17:07

Website Operators Are On Notice: Recent Events May Force Change

Published in

Publications

Tagged under

Tuesday, 13 February 2018 12:58

Is Your Website ADA Compliant?

Published in

Publications

Tagged under

X Feed

Contact Info

ForsterBoughman

2200 Lucien Way, Suite 405

Orlando (Maitland), Florida 32751

2200 Lucien Way, Suite 405

Orlando (Maitland), Florida 32751

Local: (407) 255-2055

Toll-free: (855) WP-GROUP

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Office hours: Open weekdays

from 8:30 AM to 5:30 PM