Introduction

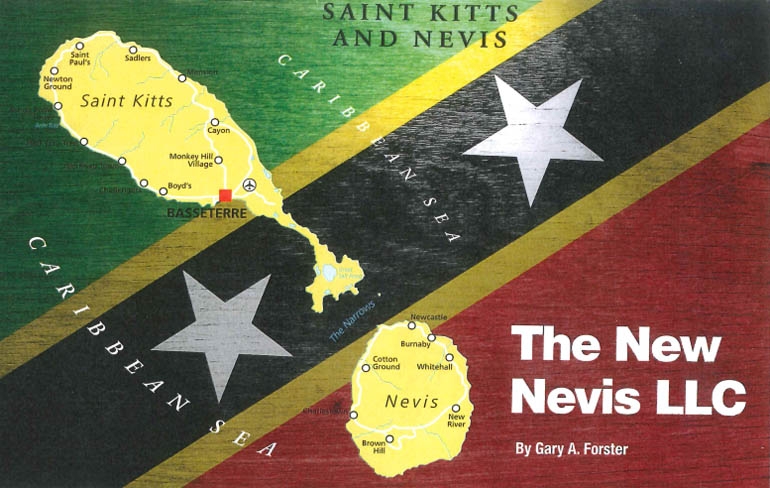

Nevis is a small island located in the West Indies of the Eastern Caribbean. Nevis is primarily known in the United States for being the birthplace of founding father Alexander Hamilton. Other historical significance includes a period during which Nevis was home to substantial sugar plantations and the hub of the English slave trade. Nevis is one of the two islands that constitute the Federation of St. Kitts and Nevis.

The first ordinance adopted in Nevis establishing a beneficial planning entitft the Nevis asset protection trust was the Nevis International Exempt Trust Ordinance. See Nevis International Exempt Trust Ordinance (1994, as amended). The trust ordinance was modeled on the Cook Islands International Trust Act passed in 1984. The Nevis International Exempt Trust Ordinance offers several protective features, including prohibitions against the enforcement of foreign judgments against trust assets, limited fraudulent transfer remedies, and binding choice of law provi-sions. To complement the trust Nevis adopted a limited liability company ordinance in 1995.